Everybody has a credit score, but many people still don’t understand exactly what it is and how it affects them, especially if they were never taught about managing finances growing up. Through our LiSA Initiative, the following Focus on YOUR Money webinar* tips will show you how to improve your credit score, as well as how it is calculated.

Simply put, credit is a way to gauge a person’s trustworthiness with regard to paying back the money that they borrow. If your friend asked you for $150 to pay for a new pair of shoes, you may ask yourself: how likely is it that he’ll pay me back? You might look to how much money he owes and how timely he has been at paying those loans back in the past. This is very similar to the risk assessment that credit card and mortgage companies do on you in the form of credit reports and credit scores.

Some financial advice columnists have recently become adamant about paying cash for everything, even your car, and your home. We don’t adhere to that philosophy; after all, if you’re using cash for everything, you’re not impacting your credit at all, and there are ways you can improve your score with every purchase you make. If done correctly, using credit can be a very positive and powerful thing.

The Difference Between Your Credit Report and Credit Score

Though related, your credit report and your credit score are actually two separate things. A credit report is a document that tells the history of your financial life. There are three major credit bureaus that collect your personal information (name, address, social security number) and financial data (loans, collections, bankruptcies, and number of accounts) and compile it all into your credit report.

The activity on your credit report is then used to derive your credit score, which is a number—usually between 300 and 850—that acts as a sort of “grade” that represents your creditworthiness. The higher your score, the lower the credit risk is to potential lenders, and vice versa.

The activity on your credit report is then used to derive your credit score, which is a number—usually between 300 and 850—that acts as a sort of “grade” that represents your creditworthiness. The higher your score, the lower the credit risk is to potential lenders, and vice versa.

You’re entitled to a free credit report every year through AnnualCreditReport.com. Take advantage of this by making sure you check your score every year. An easy way to remember to check your score might be to always do it during your birthday month. You can also have a service like Credit Karma check your credit score multiple times a year and report it back to you. Regardless of how you check your score, it’s important that you do so. You have to know your numbers to change your numbers, after all.

How is Your Credit Score Calculated?

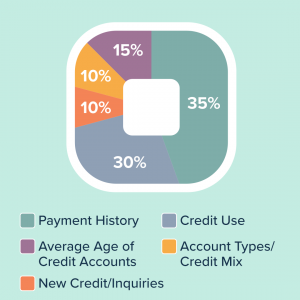

Your credit score is made up of five aspects of your finances in the following proportions:

Your credit score is made up of five aspects of your finances in the following proportions:

-

Payment History – 35%

The largest portion of your credit score is based on how timely you are in making payments on your loans. Late payments can stay on your credit report for up to 7 years, so the most important action you can take to keep up your score is to always pay on time.

-

Credit Usage – 30%

Credit bureaus will keep track of the amount of your available credit you are currently using. The more you’re using, the lower your score will be, which is why your credit utilization should always be less than 30% (e.g., if you have a $10,000 credit limit on your cards, you never want to be owing more than $3,000 in credit).

-

Average Age of Credit Accounts – 15%

The longer your accounts have been open, the higher your score. This shows how long you’ve been responsibly managing your finances. This also means you shouldn’t close any of your accounts—keep them open to improve the average age of your overall credit.

-

Account Types/Credit Mix – 10%

A diverse variety of open accounts will prove to lenders that you responsibly manage multiple forms of debt. For example, having ten credit cards will look less reliable than if you were managing a mortgage, car payment, student loans, and two credit cards all at once.

-

New Credit/Inquiries – 10%

There are two types of credit inquiries: hard inquiries and soft inquiries. Avoid the hard inquiries—these are the ones that affect your score, sometimes by up to five points. Hard inquiries are any applications for new loans, cards, or other credit lines. Soft inquiries are credit checks made by your landlords or by your employer when applying for things like apartments and jobs. Also, remember that you never get penalized for checking your own score.

There are two types of credit inquiries: hard inquiries and soft inquiries. Avoid the hard inquiries—these are the ones that affect your score, sometimes by up to five points. Hard inquiries are any applications for new loans, cards, or other credit lines. Soft inquiries are credit checks made by your landlords or by your employer when applying for things like apartments and jobs. Also, remember that you never get penalized for checking your own score.

Who is Calculating Your Score?

Your credit score is calculated by each of three major credit recording bureaus: Experian, TransUnion, and Equifax. Your score may differ between each of these three bureaus because each has its own calculation model. Models are specific methods of statistical analysis used by bureaus to evaluate your worthiness to receive credit. The two major credit-scoring models are FICO (or Fair Isaac Corporation) and VantageScore.

FICO scores are the most common credit score model. The FICO score is used in over 90% of U.S. lending decisions and has been an industry standard for over 25 years. You don’t need a large income to have a high FICO score, but a high score will always save you money in the long run by lowering your loan payments and your interest rates. FICO scores have a range from 300 – 850. However, you can have more than one FICO score, some of which can range from 250 – 900. If you’d like to learn more about FICO score versions, you can read about them here.

VantageScore was created in 2006 as an alternative to FICO to benefit new credit users. It can be calculated using as little as one month of credit history and has the same range and similar weighting as your FICO score. While your payment history and credit utilization are still the most important factors for your VantageScore, less emphasis is put on the age of your credit, account diversity, and new credit lines.

Can I Improve My Credit Score?

Anybody can improve their credit score by monitoring their payments, inquiries, and credit usage. Take these steps to improve your score:

- Check your score to establish your baseline.

- Dispute any errors on your reports.

- Set up payment reminders or autopay.

- Limit hard inquiries by not applying for new cards or loans.

- Pare down your credit usage to a 30% limit.

- Check your score as often as you can and watch out for fraud.

- Don’t close old accounts after you pay them off.

Have patience! Your score won’t change overnight but establishing good habits will bring a change over time. To make things even easier, follow three simple rules: never max out your cards, make your payments on time, and try never to carry a balance. Doing these three things is guaranteed to stabilize your credit score. Take what you’ve learned, take action, and your score will change before you know it.

Read our other articles in the Focus on Your Money series to get tips on saving and budgeting.

* Webinars are available to current FFS Agents.