When you imagine your retirement years, what do you see? Long walks on the beach, spending time with your grandkids, traveling the world, or fishing on the lake? Whatever your dream, retiring for the workforce in time to enjoy your golden years means you need to start planning now!

Here are some popular investment vehicles that can help you build your retirement nest egg and plan for a financially secure future.

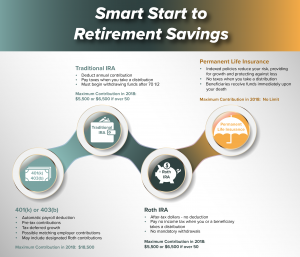

401(k) or 403(b) Plan

A company-sponsored 401(k) or 403(b) plan is one of the most popular ways to fund your retirement. With automatic payroll deductions, pre-tax contributions, and tax-deferred growth, it’s a smart way to reduce your current tax liability and save over the long term. These plans typically offer a broad range of investment options with varying degrees of risk, and a loan feature. Many employers also offer a matching contribution, up to a certain percentage, which is essentially free money!

Traditional IRA

A Traditional IRA allows you to deduct the amount of your total annual contributions, in most cases, when you file the same year’s income taxes, with taxes taken in the year you withdraw funds from your account.

Most Traditional IRAs offer a variety of investment options, including stocks, bonds, mutual funds, and money market securities, and any earnings receive the benefit of tax-deferred growth. Contributions can typically be deducted from your taxable income, depending on your income level and whether you or your spouse have 401(k) or 403(b) accounts. You then pay taxes on the contributions and earnings when you withdraw the funds.

Ideally, distributions occur during your retirement years when you qualify for a lower tax bracket, benefiting from the tax deferment. With traditional IRAs, you must begin making regular withdrawals after age 70 ½, with the ability to withdraw up to $10,000 without any withdrawal penalty for qualifying expenses before the age of 59 ½.

Roth IRA

A Roth IRA also allows you to contribute after-tax dollars to an account. Your contributions, however, grow tax-free, which means that you won’t pay any income tax when you take a distribution. These accounts are especially attractive for young investors and those who expect to graduate into a higher tax bracket in the future. Since your contributions (excluding earnings) were made with after-tax dollars, you can initiate a withdrawal at any time. To withdraw earnings without penalty, you must be 59 ½ years of age and have held the account for at least 5 years.

Permanent Life Insurance

One often overlooked retirement savings vehicle is an Indexed Universal Life Insurance policy (IUL). Not only can it protect your family’s financial security during your working years with a death benefit, but it also provides the potential for significant cash value accumulation. Depending upon the policy, the cash value can be invested in a fixed fund that offers access to higher credited interest rates and the protection of a guaranteed minimum, or in several different equity indexes. IULs do place a cap on your gains, but they reduce your risk by protecting your principle so that if the market performs poorly, none of your funds will be lost.

One often overlooked retirement savings vehicle is an Indexed Universal Life Insurance policy (IUL). Not only can it protect your family’s financial security during your working years with a death benefit, but it also provides the potential for significant cash value accumulation. Depending upon the policy, the cash value can be invested in a fixed fund that offers access to higher credited interest rates and the protection of a guaranteed minimum, or in several different equity indexes. IULs do place a cap on your gains, but they reduce your risk by protecting your principle so that if the market performs poorly, none of your funds will be lost.

Upon retirement, you can take tax-free distributions of your cash value, and when you pass on, the tax-free death benefit will protect your beneficiaries against financial uncertainty. Unlike other forms of investment, these funds will be available immediately to the beneficiaries as tax-free income.

Take a Step

The secret to saving money for a comfortable retirement is to start early and contribute regularly. Talk with your financial advisor to discuss the most appropriate investment vehicles and options to help fund your golden years!